Analysis of Global Climate Finance Trends

November 2025 - CAFIID Climate Finance Community of Practice

Introduction

Global climate finance has undergone dramatic growth over the past decade, with annual flows eclipsing the symbolic trillion-dollar mark and continuing to advance. This surge in climate finance has largely been a story of investment in mitigation activities, with heavy concentration in renewable energy, electric transport, and low-carbon infrastructure. Regionally, finance remains focused in China, the EU, and the United States, while low-income countries continue to rely heavily on concessional and multilateral funding.

The climate finance field continues to mature, becoming increasingly sophisticated in the way capital is structured and deployed. Widely adopted practices include the strategic use of public finance to de-risk private investment, the expansion of blended finance, greater integration of climate risk into financial decision-making, and an increased focus on equitable, just transition initiatives. Another defining trend has been the rapid expansion of green and sustainable debt markets, as green bonds have evolved from a niche instrument into a mainstream channel for mobilizing private capital toward climate goals. More recently, there is a growing support for allocations to new investment taxonomies, such as nature-based solutions.

Despite this remarkable growth, total flows remain far below the levels needed to meet the Paris Agreement’s goals. There is an imbalance in allocations, with adaptation lagging considerably relative to climate mitigation investments. Furthermore, despite the progress achieved, climate finance is entering an era of uncertainty, shaped by geopolitical tensions, emerging resistance to climate friendly policies, and rapidly evolving global economic conditions.

Global Climate Finance Trends Over the Past Decade

Figure1: Global Climate Finance Flows (2014-2025)

Source: Energy transition investment trends 2025 (BloombergNEF)

Over the past decade, global climate finance has experienced a significant increase, reflecting growing recognition of the urgent need to address climate change. According to the Climate Policy Initiative (CPI), average annual climate finance flows rose from about USD 653 billion in 2019/2020 to approximately USD 1.3 trillion in 2021/2022, before reaching USD 1.46 trillion in 2022 (CPI, 2023). More recent estimates suggest that flows exceeded USD 1.5 trillion in 2023, representing a more than twofold increase compared to a decade ago (CPI, 2024). This growth has been driven largely by mitigation-focused investments, particularly in renewable energy and low-carbon transport. According to the Climate Policy Initiative (CPI), whose "Global Landscape of Climate Finance" reports are considered the benchmark for the field, annual global flows increased from an average of approximately $364 billion per year between 2011-2012 to over $1.3 trillion per year in 2021-2022 (Climate Policy Initiative, 2023). This surge, however, still falls drastically short of what is required. The same CPI report estimates that to achieve Paris Agreement goals, climate finance flows must increase by at least five-fold annually by 2030, highlighting a persistent and significant financing gap.

A related measure focused on clean energy transition investment has also seen dramatic growth. BloombergNEF reports that global clean energy investment reached USD 1.8 trillion in 2023 and further expanded to USD 2.1 trillion in 2024, with strong growth in electric vehicles, renewables, power grids, and battery storage (BNEF, 2024).

Public finance flows to developing countries have also shifted during this period. After years of falling short, developed countries finally met and slightly surpassed the USD 100 billion annual climate finance goal in 2022, according to the OECD (OECD, 2024). Although the methodology for calculating these flows remains contested, this milestone would mark an important step in international climate cooperation.

The Geography of Climate Finance

Climate finance is highly concentrated in a few economies. China has emerged as the single largest investor, spending approximately USD 680 billion in 2024 on clean energy, mainly driven by large-scale solar, battery production, and electric vehicle deployment (IEA, 2024). The European Union is also strong, with investments around USD 370 billion annually, particularly in grid modernization and renewable energy expansion (IEA, 2024). The United States recorded strong growth following the Inflation Reduction Act (IRA), surpassing USD 300 billion in 2024, but investment showed a decline in early 2025 due to policy uncertainty, highlighting the vulnerability of finance flows to political shifts (BNEF, 2025). In contrast, emerging and developing economies continue to rely heavily on concessional loans and multilateral development banks, as private flows remain limited in low-income regions (MDB Joint Report, 2023).

Sectoral and Thematic Trends

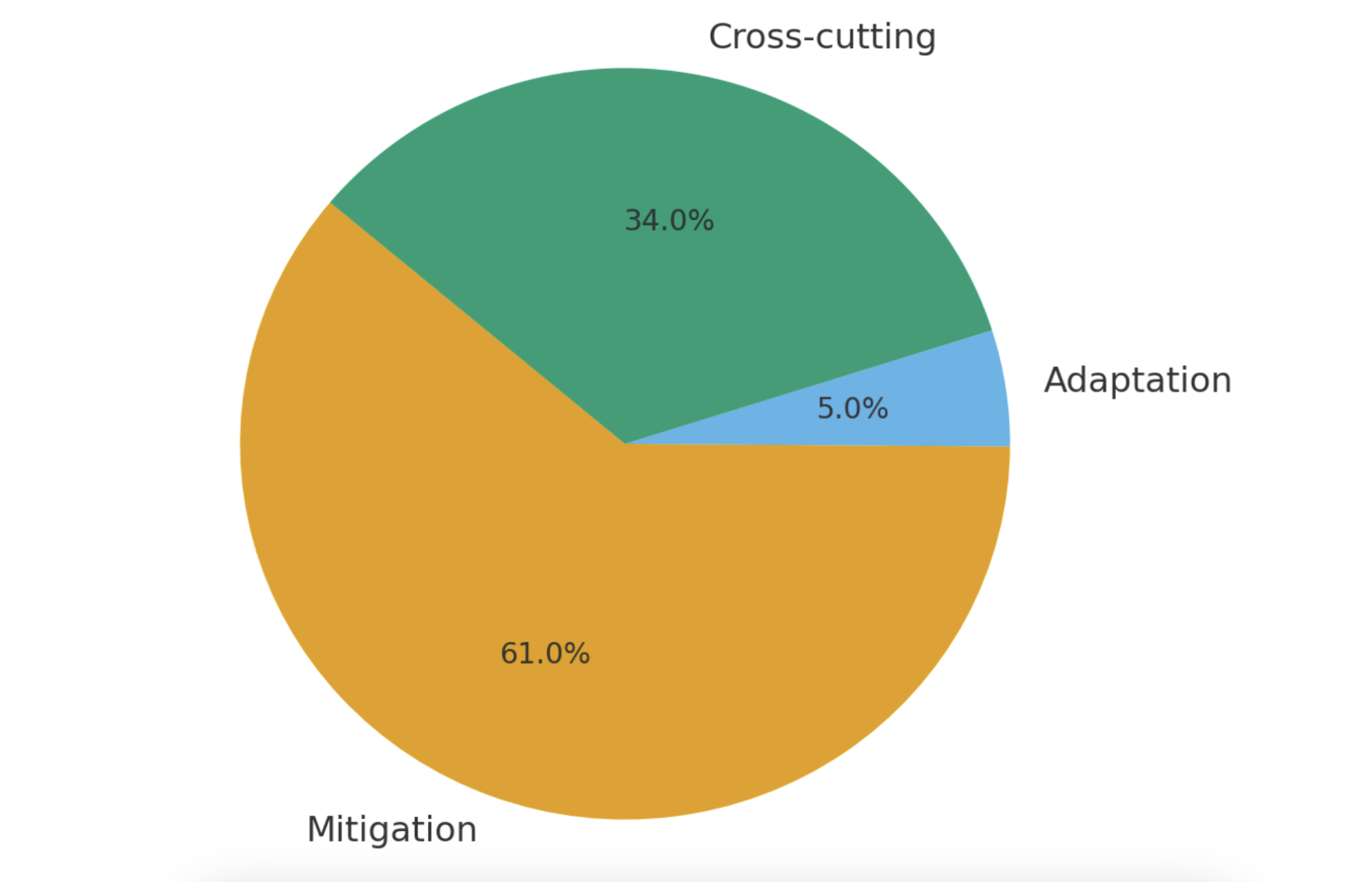

Figure 2: Climate Finance Allocation by Sector (2025)

Source: Climate Policy Initiative (2023), Global Landscape of Climate Finance; UNEP (2023), Adaptation Gap Report

Mitigation projects continue to dominate global climate finance. Renewables and electrified transport accounted for the bulk of the increase, with electric vehicles overtaking renewable energy as the largest single category of clean energy investment in 2023 (BNEF, 2024). However, adaptation finance, while growing, remains significantly underfunded. CPI data indicates that only about 5–7 percent of tracked flows were directed towards adaptation, amounting to USD 63–69 billion annually in 2021/2022 (CPI, 2023; UNEP, 2023). This is far below the estimated adaptation needs of developing countries through 2030, revealing a persistent gap in climate change resilience financing.

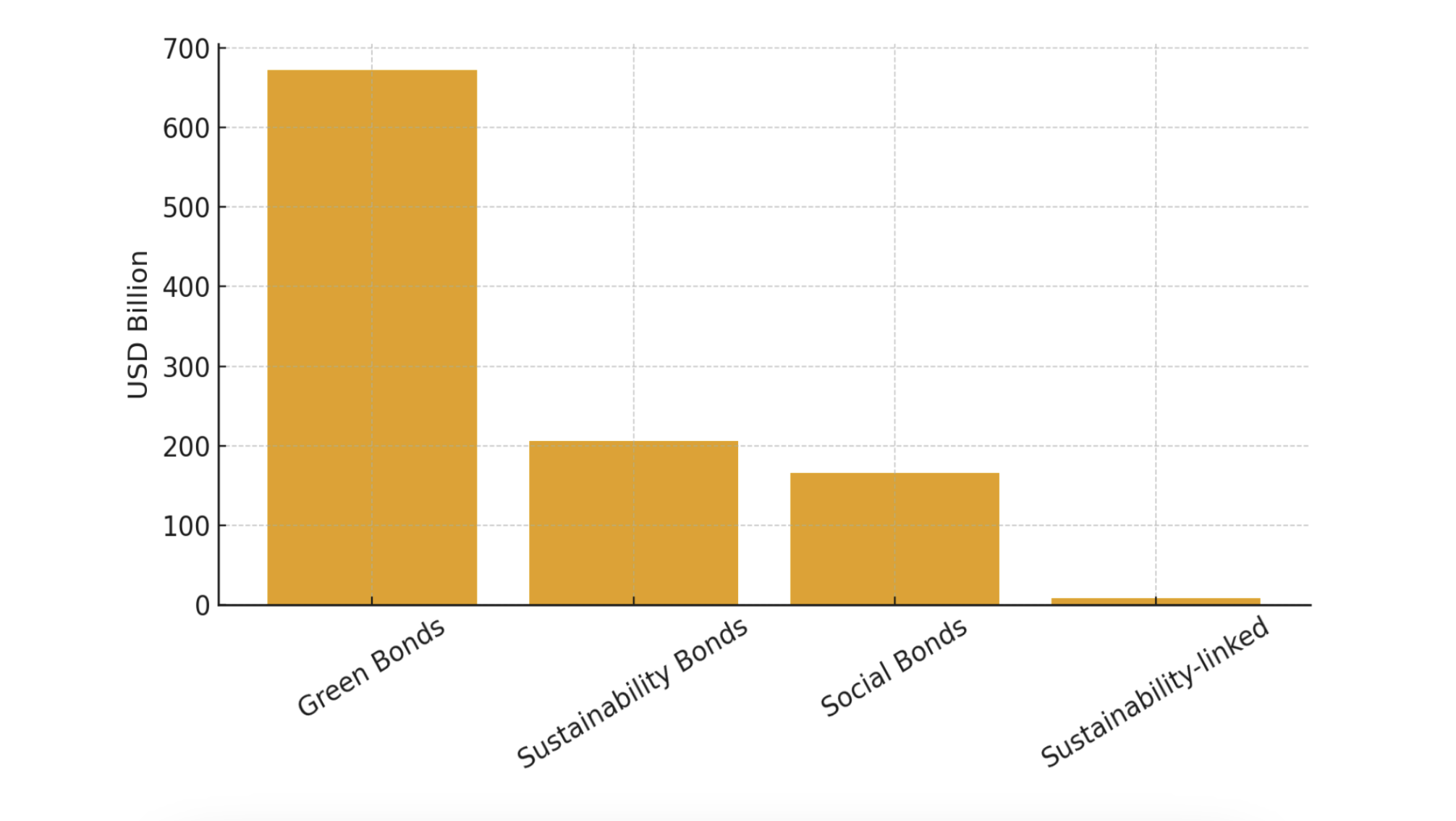

Another notable trend is the rapid growth of green and sustainable debt markets. The Climate Bonds Initiative (CBI) reports that cumulative issuance of green, social, sustainability, and sustainability-linked (GSS+) bonds surpassed USD 5.4 trillion by the third quarter of 2024, with about USD 671 billion in aligned green bonds issued in 2024 alone (CBI, 2024). Countries such as Chile and Uruguay have pioneered sovereign sustainability-linked bonds, tying repayment terms to climate performance indicators is a practice now being emulated by other governments.

Persistent Imbalance Between Mitigation and Adaptation

A consistent and critical trend over the decade has been the severe imbalance between funding for climate change mitigation versus adaptation. Mitigation activities, which offer more readily monetizable returns, continue to attract the vast majority of finance. CPI data indicates that mitigation captured over 90% of private climate finance and nearly two-thirds of public finance in recent years (Climate Policy Initiative, 2023). Adaptation finance, while growing, remains disproportionately low, receiving less than 10% of total global flows. This is problematic because adaptation projects, such as building climate-resilient infrastructure or developing drought-resistant crops, are essential public goods that often lack a revenue stream, making them less attractive to private capital.

Figure 3: Sustainable Finance Instruments Issued in 2024

Source: Climate Bonds Initiative (CBI) (2024)

The Explosion of Green and Sustainable Debt Instruments

A major positive development in mobilizing private capital has been the rapid innovation and scaling of sustainable debt markets. The green bond market, in particular, has matured from a niche product into a mainstream asset class. Data from the Climate Bonds Initiative (CBI) shows that annual green bond issuance exploded from roughly $37 billion in 2014 to a record $575 billion in 2023 (Climate Bonds Initiative, 2024). Furthermore, the market has diversified beyond use-of-proceeds green bonds to include instruments like sustainability-linked bonds, whose financial terms are tied to the issuer's achievement of predefined sustainability performance targets.

Best Practices and Positive Trends

Several best practices have emerged over the past decade that demonstrate effective approaches to mobilizing climate finance.

1. The Catalytic Use of Public Finance to De-Risk Investment

A recognized best practice is the strategic use of public funds to "crowd-in" private capital, particularly for projects in developing countries or nascent sectors. Multilateral Development Banks (MDBs) and national development finance institutions use tools like guarantees, concessional loans, and technical assistance to absorb risk and improve the risk-return profile for private investors. For example, the Green Climate Fund (GCF) operates on this model, with its projects successfully leveraging significant co-finance. A 2023 report on the joint climate finance of the MDBs highlights how their commitments actively mobilize private investment in clean energy and sustainable infrastructure across the globe (European Investment Bank et al., 2023).

2. Mainstreaming Climate Risk into Financial Decision-Making

A fundamental shift has been the integration of climate considerations into the core of financial governance. The Task Force on Climate-related Financial Disclosures (TCFD) played a central role in this development. By establishing a consistent structure for companies to disclose climate-related risks and opportunities, the TCFD enabled investors and regulators to make better informed decisions. While the task force was disbanded in 2023, its recommendations are being hardwired into mandatory regulations, such as the European Union's Sustainable Finance Disclosure Regulation (SFDR), creating a systemic push for capital allocation towards more sustainable and resilient assets.

3. The Strategic Application of Blended Finance

Blended finance, the strategic use of public or philanthropic capital to mobilize private investment for development has emerged as a powerful tool for directing capital to where it is needed most. The OECD (2022) has documented the growth of this approach to mobilize private finance to support climate action, noting that it is particularly effective in lower-income countries where perceived risks are higher. By using public funds to provide a first-loss capital layer or credit enhancement, blended finance structures make projects bankable for commercial investors who would otherwise not participate.

4. The Growing Focus on a "Just Transition"

An increasingly prominent positive trend is the focus on ensuring that the transition to a low-carbon economy is equitable and inclusive. "Just Transition" financing aims to support communities and workers dependent on high-carbon industries through retraining, social protection, and economic diversification programs. Initiatives like the Climate Investment Funds' (CIF) Accelerating Coal Transition (ACT) program exemplify this, providing funding to countries like South Africa and Indonesia to retire coal plants early while investing in renewable alternatives and supporting affected communities (Climate Investment Funds, 2023).

5. Recognition of Nature-Based Solutions as Climate Finance

There is growing recognition that investing in nature is a highly effective strategy for both climate mitigation and adaptation. Financing for Nature-Based Solutions (NbS) such as forest conservation, wetland restoration, and sustainable agriculture has gained considerable traction. The LEAF Coalition (Lowering Emissions by Accelerating Forest finance), a public-private initiative, is a prime example, having mobilized over $1.5 billion in corporate and government funding for large-scale tropical forest protection (LEAF Coalition, 2023).

The Emergence of Geopolitical Uncertainty

While climate finance experienced consistent and stable growth over the past decade, 2025 is testing the resilience of the global climate agenda, with major shifts in geopolitics, international trade, and multilateral cooperation. The following factors are having an impact on global climate finance.

1. Climate backlash and policy rollbacks

In early 2025, the United States withdrew from the Paris Agreement for a second time. They also exited key climate-finance initiatives by giving up the board seat on the Fund for responding to Loss and Damage (FRLD), rescinding their pledge to the Green Climate Fund (GCF) and withdrawing from the Just Energy Transition Partnerships (JETP). These changes have both a symbolic and a material impact on both the support for climate action, and dissemination of global climate finance flows, as the United States was responsible for nearly a tenth of all climate finance for developing countries (Carbon Brief, 2025).

Amid a broader affordability crisis, several governments have also paused or revised domestic climate policies. In Canada, the federal government has suspended the consumer carbon tax, a measure that had been in place since 2019. These reversals risk weakening market signals for climate investment. It is unclear whether measures such as these will encourage other nations to follow their lead.

2. Fiscal pressure and competing budget priorities

Mounting fiscal pressures are reshaping government priorities. The United States, UK, France and Germany all announced cuts to Official Development Assistance (ODA) in 2025, leading to overall cuts between 9 to 17%, on top of a 9% reduction in 2024. As ODA has declined, public climate finance also fell by 8%, raising concerns about adaptation support (Bonn Bulletin, 2025). The outlook for ODA beyond 2025 remains uncertain. In Canada, carbon market instruments such as contracts for difference have faced setbacks, raising concerns about its ability to mobilize private finance for climate action (Clean Prosperity, 2024).

Defence expenditures on the other hand, is projected to rise, potentially to as high as 5% of GDP by 2035 for NATO countries (IISS, 2025). Growing allocations to defence will crowd out some other fiscal expenditures, potentially impacting climate finance

3. Fracturing of the global trade order and multilateral system

The United States has withdrawn from several trade arrangements and introduced new tariffs on nations around the globe, contributing to instability in global markets. This has fueled a broader trend toward fragmented multilateralism, prompting some nations to reassess their commitments and adopt more risk-averse investment practices. Collectively, these developments introduce new uncertainty into the climate finance landscape, potentially slowing progress toward global adaptation and mitigation goals.

Conclusion

The past decade has shown that mobilizing climate finance at scale is possible, but also that success depends on more than capital, requiring alignment between policy, markets, and international cooperation. Innovative financing tools, from blended finance to sustainability-linked bonds, have demonstrated how public and private actors can work together to channel resources toward both mitigation and adaptation. Similarly, attention to just transition and nature-based solutions highlights the growing understanding that climate finance must address social and ecological outcomes alongside carbon reduction.

At the same time, structural imbalances remain. Adaptation finance is under-resourced, low-income regions face persistent access barriers, and political and economic uncertainty continues to influence the stability of global flows. Looking ahead, the emerging geopolitical shifts, policy backlashes, and evolving economic pressures of 2025 signal that climate finance will need to be increasingly flexible and resilient. The lessons of the past decade suggest that strong international coordination will be critical to sustaining progress and closing the gap between ambition and investment in the years to come.

-

BloombergNEF. (2024). Energy transition investment trends 2024. Bloomberg New Energy Finance.

BloombergNEF. (2025). Energy transition investment trends 2025. Bloomberg New Energy Finance.

Climate Bonds Initiative. (2024). Sustainable debt market summary 2024. Climate Bonds Initiative.

Climate Investment Funds. (2023). Accelerating coal transition (ACT) program. Climate Investment Funds. https://www.climateinvestmentfunds.org.

Climate Policy Initiative. (2023). Global landscape of climate finance 2023. Climate Policy Initiative. https://www.climatepolicyinitiative.org.

Climate Policy Initiative. (2024). Global landscape of climate finance 2024 update. Climate Policy Initiative. https://www.climatepolicyinitiative.org.

European Investment Bank, Asian Development Bank, World Bank, & other Multilateral Development Banks. (2023). Joint report on multilateral development banks’ climate finance 2023. https://www.ebrd.com/mdb-joint-report.

International Energy Agency. (2024). World energy investment 2024. International Energy Agency. https://www.iea.org.

LEAF Coalition. (2023). Annual report 2023: Lowering emissions by accelerating forest finance. https://www.leafcoalition.org.

Organisation for Economic Co-operation and Development. (2022). Blended finance funds and facilities: 2022 survey results. OECD Publishing. https://doi.org/10.1787/9cb75fdf-en.

Organisation for Economic Co-operation and Development. (2024). Climate finance provided and mobilised by developed countries in 2013–2022. OECD Publishing. https://doi.org/10.1787/d19d14de-en.

United Nations Environment Programme. (2023). Adaptation gap report 2023. United Nations Environment Programme. https://www.unep.org.

Bonn Bulletin – Bonn bulletin: Developing nations ask x3 adaptation finance by 2030

Climate Policy Initiative – Global Landscape of Climate Finance 2025: https://www.climatepolicyinitiative.org

CARE Canada – https://careclimatechange.org/hollow-commitments-2025/

Clean Prosperity – https://cleanprosperity.ca/carbon-contracts-for-difference-face-challenges-with-transparency-and-eligibility-barriers-that-we-need-to-overcome/?utm_source=chatgpt.com

Carbon Brief – https://www.carbonbrief.org/analysis-nearly-a-tenth-of-global-climate-finance-threatened-by-trump-aid-cuts/

Heinrich Böll Foundation – Climate Finance: https://boell.org

International Institute for Strategic Studies – https://www.iiss.org/online-analysis/military-balance/2025/02/global-defence-spending-soars-to-new-high/

MSCI – Sustainability and Climate Trends 2025: https://www.msci.com

UNCTAD World Investment Report 2025: https://unctad.org